Finance

Press Release

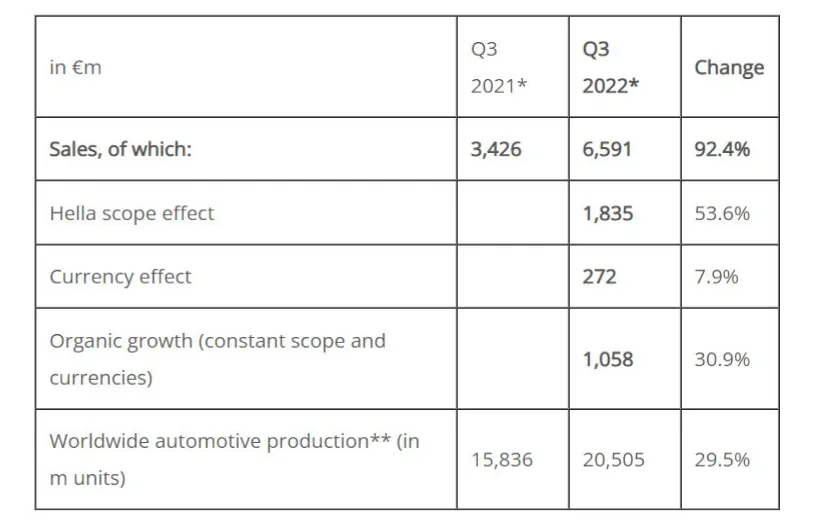

UPGRADED FULL-YEAR 2022 SALES GUIDANCE TO BETWEEN €24.5bn AND €25.5bn (vs. between €23 billion and €24 billion previously)

Patrick KOLLER

CEO of Faurecia

Related documents |

Download all | 2.35 MB | |

|---|---|---|---|

| Third-quarter 2022 sales - Press release | 18th December 2023 | 606.05 KB | |

| Third-quarter 2022 sales - Presentation | 18th December 2023 | 2.01 MB |