Short fiscal year 2022: HELLA once again achieves record level with order intake of €1 billion per month

- High production volumes in the lighting business in China; Electronics Business Group meets the strong demand for product solutions for electromobility and automated driving; Lifecycle Solutions successful in the spare parts and agricultural machinery business

- Order intake was around €7 billion, especially for key automotive future trends and in strategic growth fields

- Dividend payment totalling €2.88 per share proposed: continuation of established dividend policy and special dividend after HBPO share sale

- Outlook for the fiscal year 2023: adjusted sales to be in the range of around €8.0 to 8.5 billion and operating income margin to be in the range of around 5.5 to 7.0 percent; net cash flow in relation to sales at approximately 2 percent

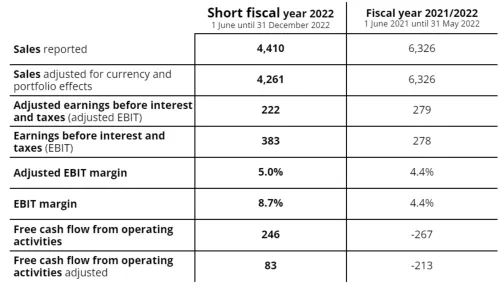

HELLA, the automotive supplier operating under the FORVIA umbrella brand, today published its full and final results for the short fiscal year 2022 (1 June to 31 December 2022), confirming the preliminary key figures published on 16 February 2023. In the seven-month short fiscal year 2022, HELLA generated reported sales of €4.4 billion; adjusted for currency and portfolio effects, this figure was €4.3 billion. Adjusted earnings before interest and taxes (adjusted EBIT) amount to €222 million; the adjusted EBIT margin improved to 5.0 percent (fiscal year 2021/2022: 4.4 percent). Reported EBIT has increased to €383 million and the EBIT margin to 8.7 percent (fiscal year 2021/2022: 4.4 percent). This includes the book gain from the sale of the shares in the joint venture HBPO (€250 million). Reported free cash flow from operating activities improved to €246 million; adjusted, it was €83 million. The short fiscal year was inserted after HELLA changed its fiscal year to the calendar year as of 1 January 2023.

Michel Favre

HELLA CEO

High production volumes in the lighting business in China

In the short fiscal year 2022, the Lighting Business Group achieved sales of €2.1 billion. Especially in the Chinese market, the lighting business has developed very positively. This is also related to production launches in the previous fiscal year, which continued to ramp up. The EBIT is €44 million, improving the EBIT margin to 2.1 percent (fiscal year 2021/2022: 0.4 percent).

Electronics Business Group faces strong demand for product solutions for electromobility and automated driving

In the Electronics Business Group, sales amount to €1.9 billion. The main reason for this was the high demand for various electronic products, including product solutions for electromobility and automated driving. EBIT amounts to €124 million, and the EBIT margin is 6.5 percent (fiscal year 2021/2022: 5.5 percent).

Lifecycle Solutions successful in the spare parts and agricultural machinery business

In the Lifecycle Solutions Business Group, sales amount to €0.6 billion. One factor here was the success of the spare parts business in key country markets, such as Mexico and the USA. In the commercial vehicle business, all relevant customer segments recorded high demand, for example in the business with manufacturers of agricultural machinery, trucks and trailers. The segment's EBIT is €58 million, with an EBIT margin of 10.1 percent (fiscal year 2021/2022: 12.4 percent). The slightly lower margin is due to capital expenditure in the global distribution network as well as shifts in the product mix.

Order intake of around €7 billion, especially for key automotive future trends and in strategic growth fields

In the seven-month short fiscal year 2022, HELLA acquired customer projects amounting to €1 billion per month; this puts the order intake at a record level once again. Among customer projects are product solutions for key automotive future trends and strategic growth areas, including orders for Front Phygital Shields and SSL | HD headlamps, for high-voltage converters, 77 GHz radar sensors as well as for the digital vehicle entry system Smart Car Access.

Dividend payment totalling €2.88 per share proposed

Based on the results for the short fiscal year 2022, the payment of a dividend totalling €2.88 per share is to be proposed to the Annual General Meeting on 28 April 2023. This includes a regular dividend of €0.27 per share. HELLA is thus continuing its established dividend policy of paying out around 30 percent of net profit as a dividend (excluding the income from the HBPO shares sale). The exit from HBPO is to be taken into account with a proposed special dividend of €2.61 per share. This is made possible not least by the Company's very solid financial position. This would bring the total amount distributed to €320 million.

Record sales forecast in the range of around €8.0 and 8.5 billion

For the fiscal year 2023 (1 January to 31 December 2023), HELLA expects to generate currency and portfolio-adjusted sales in the range of around €8.0 to 8.5 billion. The operating income margin is forecast to be in the range of around 5.5 to 7.0 percent. With regard to net cash flow in relation to sales, HELLA assumes a figure of approximately 2 percent. In this regard, the Company expects an initially lower operating income margin and net cash flow in relation to sales in the first half of the fiscal year. This outlook is based on HELLA's expected global automotive production of around 82 million vehicles.

Michel Favre

HELLA CEO

As HELLA has changed its fiscal year to the calendar year with effect from 1 January 2023, a short fiscal year was inserted from 1 June to 31 December 2022. This means that the key financial figures are only comparable with the fiscal year 2021/2022 to a limited extent. The annual report on the short fiscal year 2022 can now be downloaded from the website of HELLA GmbH & Co. KGaA.

Please note: You will find this press release and corresponding images in our press database at: www.hella.com/press