First-quarter 2022 sales

- Organic sales growth of +1.1% (Faurecia stand-alone), outperforming automotive production by 530bps

- First release of FORVIA’s FY 2022 guidance (including 11 months of consolidation of HELLA)

- Increased financial flexibility to get through the current uncertain environment, thanks to covenant renegotiation, suspended dividend payment in 2022 and upgraded asset divestment program by end 2023

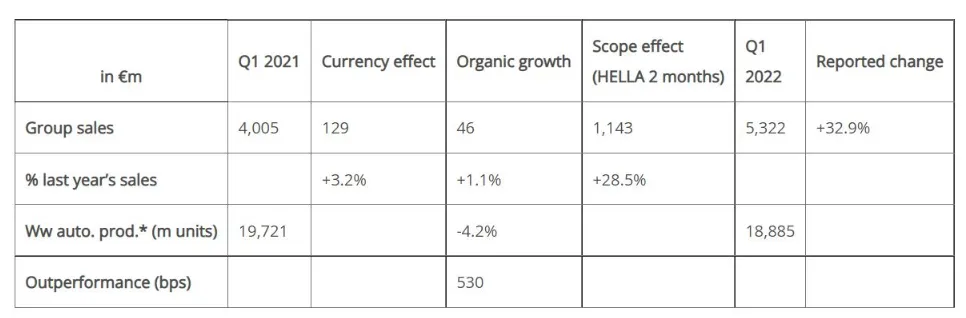

Q1 sales of €5.3bn, up 33% on a reported basis and up 1.1% on an organic basis

- Sales included first two months (February and March) of consolidation of HELLA for €1.1bn.

- On an organic basis (Faurecia stand-alone and excl. currency effect), sales were up 1.1%, outperforming the market by 530bps.

- In March sales were up 35% on a reported basis but down 6% on an organic basis, mainly reflecting a 20% organic drop in Europe due to the war in Ukraine, not fully offset by organic growth in all other regions (sales in China grew by 6%, despite first Covid restrictions in some areas).

First release of FY 2022 guidance for FORVIA (Faurecia including 11 months of consolidation of HELLA)

Based on an updated and cautious assumption for worldwide automotive production of 74.2 million light vehicles in 2022 (vs. an assumption of 78.7m in February), the FY 2022 guidance for FORVIA is:

- Sales between €23 billion and €24 billion (including c. €1.5 billion from the combined effect of currencies and raw materials),

- Operating margin between 4% and 5%,

- Net cash-flow at breakeven.

This guidance assumes an automotive production of 15.1 million LVs in Europe and 20.1 million LVs in China (vehicles segment in line with CAAM, i.e. excluding vehicles > 3.5t), is based on full-year average currency rates of 1.13 for USD/€ and of 7.20 for CNY/€ and takes into account the Group’s latest update of net impact from cost inflation.

Increased financial flexibility

In order to increase the Group’s financial flexibility to get through the current uncertain environment:

- Faurecia has proactively renegotiated its debt covenant with banks: covenant level will not be tested at June 30, 2022 and will be of 3.75x at December 31, 2022 (instead of 3.0x) before returning to 3.0x as from June 30, 2023,

- The Board of Directors has decided, at its latest meeting held yesterday, to propose at the next Shareholders’ meeting convened on June 1 to exceptionally suspend dividend payment in 2022,

- Faurecia has decided to upgrade its asset divestment program from a target of €500 million of proceeds to be closed by end 2023 to a target of €1 billion of proceeds to be closed by end 2023.

Our industry has again to adapt to a challenging environment generating new uncertainty, after two difficult years due to the pandemic and the shortage of semiconductors, whose effects are continuing to impact the automotive industry.

Even if the war in Ukraine should mainly impact activity in Europe, we have to adapt to this new disruption, whose duration and magnitude of impacts, as of today, remain uncertain.

The recent acquisition of HELLA, closed at the end of January, makes us stronger and more resilient than ever but it has also de facto increased our debt leverage. As part of our agile management of the crisis, we have decided to proactively negotiate with banks a temporary waiver on our debt covenant in order to increase our financial flexibility. In addition, we have also revised upward our planned asset divestment program to be achieved by the end of 2023.

Further to these measures, the Board of Directors has also decided to propose to our next Shareholders’ meeting to exceptionally suspend dividend payment in 2022.

Our full-year 2022 guidance for FORVIA (Faurecia + 11 months of consolidation of HELLA), that we release today for the first time, is based on a cautious assumption for worldwide automotive production of 74.2 million vehicles, reflecting the current low visibility, and nevertheless demonstrates the strong resilience of FORVIA.

We are more than ever convinced about the huge potential of profitable growth and value creation of FORVIA, accelerated by the acquisition of HELLA that enhances our advanced technology portfolio and generates significant synergies. We also strongly reaffirm our commitment to reduce indebtedness post-HELLA acquisition, taking all necessary measures to accelerate return to the planned deleveraging trajectory, even if the current context imposes some delay in 2022.”

Patrick Koller

CEO of Faurecia

Related documents |

Download all | 6.12 MB | |

|---|---|---|---|

| First-quarter 2022 sales - Press release | 18th December 2023 | 3.19 MB | |

| First-quarter 2022 sales - Presentation | 18th December 2023 | 3.19 MB |