Resilient performance in a volatile environment

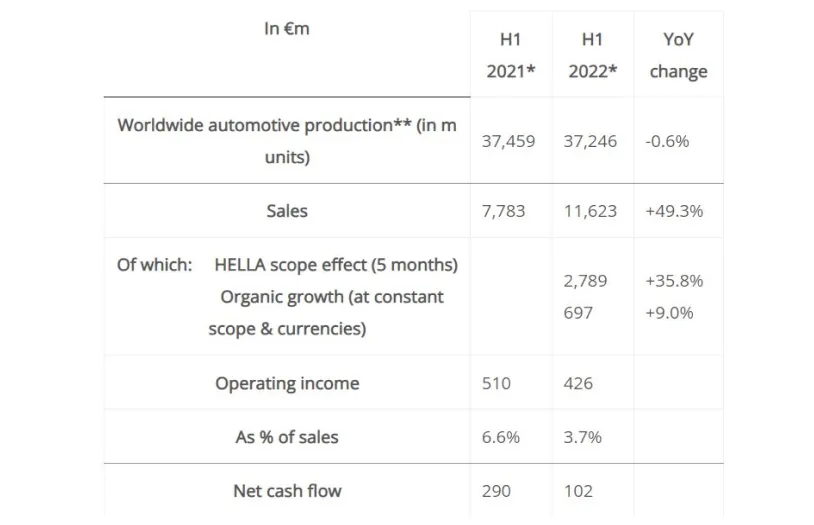

- Automotive production continued to be impacted in H1 by low activity, resulting from shortage of semi-conductors and the war in Ukraine that generated volatility in OEMs programs and supply chain disruptions, as well as the two-month lockdown in China in April and May due to Covid restrictions.

- Strong organic sales outperformance of +960bps (Faurecia “stand-alone” perimeter), of which +790bps from volume, +520bps from inflation pass-through and -350bps from regional mix.

- Resilient operating margin of 3.7%, despite all headwinds, included accretive contribution from HELLA.

- Positive net cash flow of €102 million.

Confirmed full-year 2022 guidance as announced on April 26

All financial targets, as announced on April 26, are confirmed (assuming worldwide automotive production of c. 74 million light vehicles, i.e. c. 37 million LVs in H2 2022):

- Sales between €23 billion and €24 billion,

- Operating margin between 4% and 5% of sales,

- Net cash flow at breakeven (includes building of a safety stock of around €100m at year-end to secure supplies given energy shortage risks in Europe).

Integration of HELLA on track

- HELLA is consolidated since February 1 and integration is fully on track.

- Implementation of synergies, including cost synergies of optimization > €250m in 2025, has started.

Refinancing of the HELLA acquisition largely completed, including the recent successful capital increase

- The successful capital increase of €705m in June was a significant step in the refinancing process of the acquisition of HELLA.

- After this operation, €1.7bn out of the total investment of €5.4bn is to be refinanced.

Priority to deleveraging after the acquisition of HELLA

- The divestment program of non-strategic assets of €1bn of proceeds to be closed by end 2023 is underway and will contribute to further deleveraging.

- The Group targets Net debt-to-Adjusted EBITDA ratio of 3x at the end of 2022.

“In the first half, in addition to the persistent shortage of semiconductors, which continued to generate significant volatility in orders from our customers, two major events weighed on the macroeconomic environment: the start of the war in Ukraine in February and the lockdowns in China in April and May. Finally, the acceleration of inflation impacted significantly the global economy.

In this particularly tense context, the new FORVIA group, which has included HELLA since February 1, succeeded in achieving net organic sales outperformance of +960bp, protecting its operating margin and generating positive net cash flow.

Since the beginning of the year, in addition to implementing the actions necessary to mitigate the negative impacts of the global macroeconomic environment on our operations, we have pursued our major strategic axes. Thus, in the first half, we achieved 15 billion euros in order intake, with major first orders of technologies for electrification and automated driving, such as high voltage DC/DC converters, X-by-wire solutions and front panel vision systems. We also continued to be a go-to partner for a more customized and eco-designed cockpit, recording significant contract awards for interiors, seating, display and lighting solutions featuring lightweight, energy efficient, low CO2 components and sustainable materials.

We have, since the finalization of the acquisition of HELLA at the end of January, accelerated the combination of FAURECIA and HELLA and we are deploying our program of synergies according to our plans. To participate in the refinancing of this major acquisition, now largely completed, we also carried out the planned capital increase for 705 million euros.

This capital increase operation has enabled us to improve our financial structure and contributes to our priority objective of rapid deleveraging for the Group, to which the ongoing one-billion divestment program of non-strategic assets by end 2023 will also contribute.

We are confident that the second half will allow us to improve our first half performance and fully confirm our objectives for the year. We also remain fundamentally committed to our values and convictions, particularly with regards to sustainable development. As such, we are very proud to be the first global automotive company to have recently received validation of our NET ZERO roadmap by SBTi (Science Based Target initiative), which recognizes our efficiency and foremost position to lead the urgent transformation of our industry”

Patrick Koller

Chief Executive Officer of Faurecia