Finance

Press Release

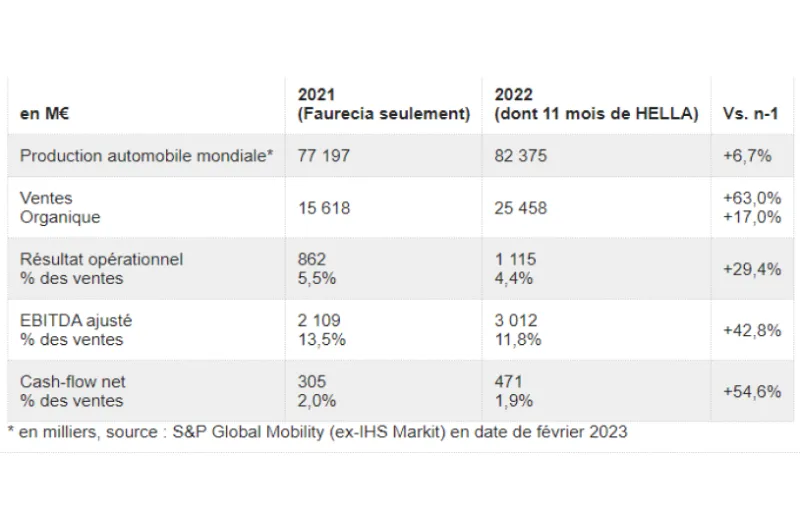

Our Achievements: Growth, Resilience, Cash Generation & Deleveraging

Our Priorities: Deleveraging, Integration & Sustainable Growth

FY 2023 Guidance

Based on the following assumptions:

FORVIA’s full-year 2023 guidance is as follows:

Patrick KOLLER

CEO of Faurecia

Related documents |

Download all | 10.53 MB | |

|---|---|---|---|

| Full-year 2022 results - Press release | 20th February 2023 | 743.23 KB | |

| Full-year 2022 results - Presentation | 20th February 2022 | 8.97 MB | |

| Financial report | 31th December 2022 | 2.25 MB |