Full-year 2021 results

A foundational year for Faurecia.

Resilient performance despite headwinds, with solid order intake

FORVIA on track to deliver on ambitions.

- Successful spin-off from the historical shareholder

- Strategic and transformative acquisition of HELLA

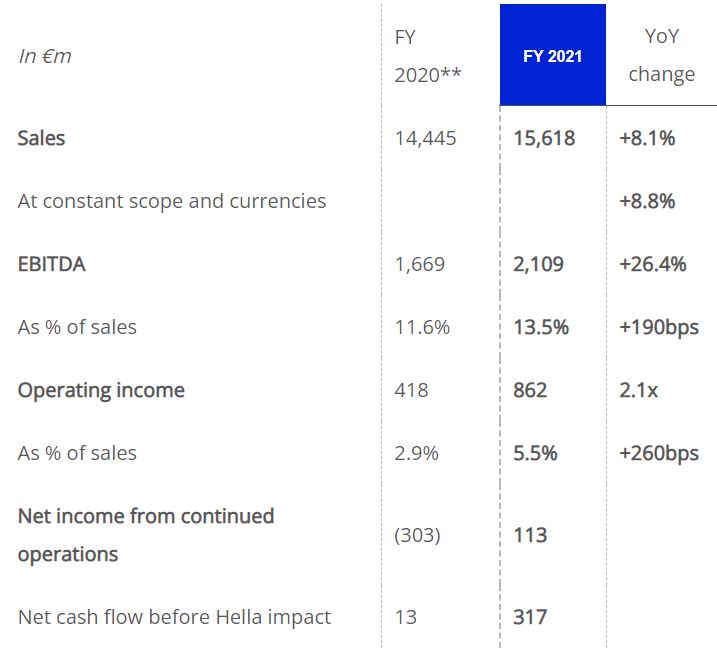

In 2021, worldwide automotive production* was strongly impacted by the semiconductor shortage and remained low for a second consecutive year at 73.4 million light vehicles (LVs), up only 3.8% vs. 2020, which had been heavily affected by the Covid-19 crisis.

* Source: IHS Markit dated February 2022, as usually restated by Faurecia, i.e. vehicles segment in line with CAAM for China

** 2020 restated for IFRS 5 (see in appendix)

At this stage and due to the recent closing of the HELLA acquisition, Faurecia is only guiding for its standalone scope. Assuming that worldwide automotive production will recover to 78.7 million vehicles in 2022, Faurecia’s standalone full-year 2022 guidance is as follows:

- Sales between €17.5bn and €18bn

- Operating margin between 6% and 7%, with H2 close to pre-Covid levels

- Net cash flow of c.€500m before HELLA acquisition impact

FORVIA on track to deliver on ambitions

- Successful closing on January 31, 2022 as expected

- Faurecia now owns a controlling stake exceeding 80% of HELLA

- Creation of FORVIA, the newly combined Group’s name

- FY 2022 guidance for the combined group to be released on April 28, 2022 (with Q1 2022 sales announcement); detailed strategic plan to be presented at a Capital Markets Day in H2 2022

2021 was a foundational year for Faurecia. Firstly, the successful spin-off from PSA/Stellantis significantly increased our free float, enlarged our international shareholder base and enhanced share liquidity. Secondly, we launched the acquisition of a majority stake in HELLA, a strategic and transformative investment that was successfully closed within five months.

For the full year, we achieved another strong sales outperformance, solid operating leverage and significant cash generation. This was in spite of the acute semiconductor shortage, unprecedented OEM production volatility with widespread Stop & Gos disruption, and one launch issue in North America.

We also recorded a solid order intake, leading to a cumulative 75 billion euros received over the past three years, including significant awards in key business segments such as Electronics and Hydrogen.

2022 will continue to be impacted by the semiconductor shortage, which should begin to ease from the second half of the year. In this context, we will continue our strict cost control and focus on operational efficiency to drive continuous improvement in our financial performance.

Our most exciting challenge for 2022 will be the great opportunity to combine our operations and teams with HELLA to create a powerful Group, which is far more than the sum of the two pre-existing companies. FORVIA is now fully on track to deliver on its ambitions.

I would like to thank our talented people for all that has been achieved in the past year – and the combined teams of Faurecia and HELLA for their commitment to make 2022 a great year for our new Group, FORVIA.

Patrick Koller

CEO of Faurecia

To find out more, please consult the PDF below.